Welcome to Board Approach

We deliver a proven Board methodology that assists private and family companies who are ready to shape and map out their business future. We bring our successful track record, wisdom, and proven Board leadership methodology to each trusted relationship.

Our team deeply understands family and privately owned businesses.

We understand that evolving your business to the next stage of its lifecycle should be a considered journey, and we are there as your partner and mentor throughout, ensuring you learn to work “on it, not in it”.

We believe that building an effective Board is at the core of setting a business up for a successful strategic exit or transition to the next generation.

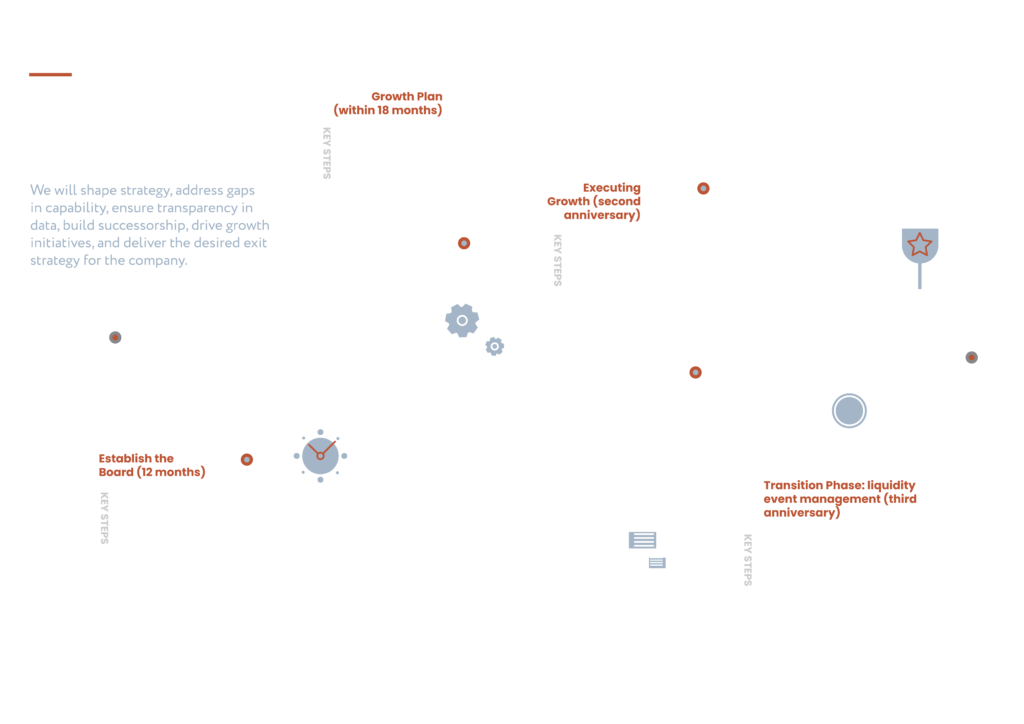

By appointing an independent chair who has walked this path before, we will shape strategy, address gaps in capability, ensure transparency in data, build successorship, drive growth initiatives, and deliver the desired exit strategy for your company.

Our Team

Board Approach provides access to its stable of high calibre Directors who are not traditionally able to be accessed by the private mid-market: a point of difference and key success factor in successfully applying the Board Approach in your business

Michael Givoni,

Director

Michael’s career sweet spot is establishing and chairing boards for large private and family-owned businesses. “I feel privileged to help others improve their lives and call them friends”.

Steven Lipchin,

Director

Steven brings Board experience from over thirty private companies. He specialises in helping “big little companies” on their journey toward becoming “little big companies”.

Michelle Coleman,

Director

Michelle is passionate about delivering revenue growth for small businesses by developing winning strategies, leveraging the latest digital tools and cultivating high-performing teams.

Our Directors

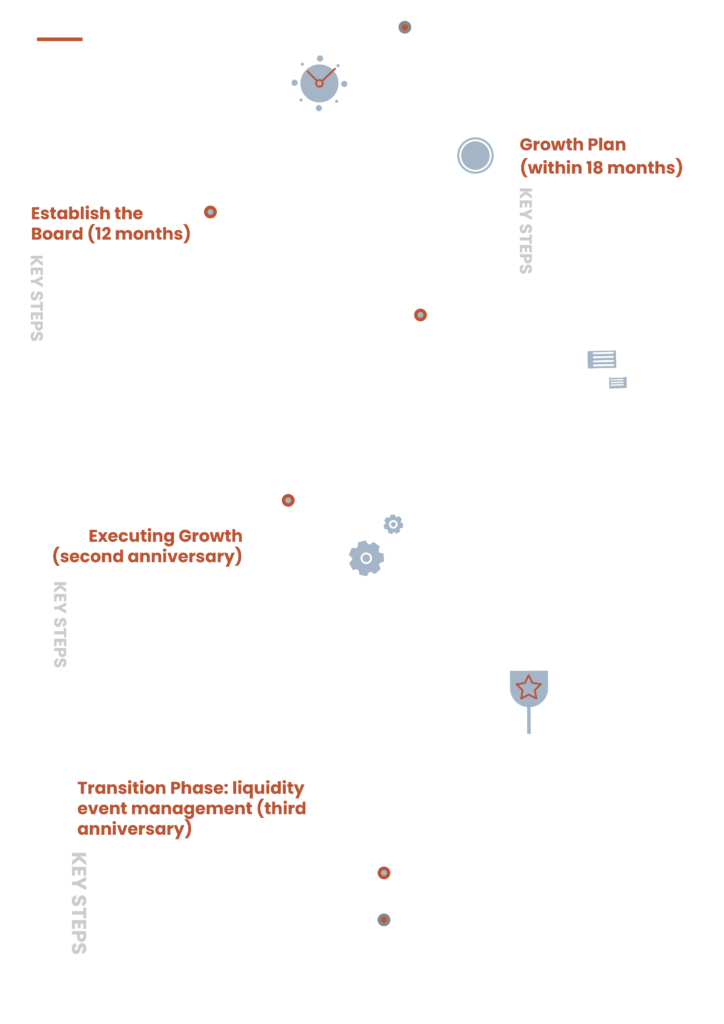

Services

The team at Board Approach provide:

- Chair Placements

- Board Effectiveness

- Board Tools

- Growth Plan

- Exit Options and Execution

- Intergenerational Transition

- Equity or Debt Raising

Case Studies

See below some sample case studies from Boards chaired by one of the founders, Michael Givoni using the methodology outlined in his recently published book: Uncommon Sense

The board identified that a staged exit or sell down of the families equity was the best option to allow the business to continue to grow beyond its family business heritage. We recruited a seasoned CEO, who had a solid reputation within the investment community, to navigate the business through an inevitable transaction.

In 2015, two PE firms (Square Peg and Five V) invested in the business, and the business continues to go from strength to strength to this day.

Once the Board addressed the executive bench strength issues, we were then able to focus on business growth objectives and store rollout. By 2021, RSEA had built a network of over 70 stores and acquired a business to fast track entry into New Zealand. The business continues to go from strength to strength.

The Board set an objective of having 50% of revenue from branded products within 5 years with less reliance on contract manufacturing (at the time in 2019, branded products were less than 20%).

Start making better

business decisions.

With Board Approach

Uncommon Sense: The Roadmap to a Great Business Board by Michael Givoni

The Roadmap to a Great Business Board’, details how private and family-owned businesses can best instigate and sustain highly effective boards which add enormous value through critical phases in the life cycle of their business.

With a track record of driving profitable business growth, author Michael Givoni is an experienced board chairman and big-picture thinker who unites people to solve problems and work towards clear end goals.